For the best experience, change the screen to portrait mode.

:::

Master-Feeder Fund Investment

Chang Hwa Bank Master-Feeder Fund Investment

- System periodically executes the master fund for conversion subscription of feeder fund, and our bank does not collect the conversion subscription fee of NTD 500 for each transaction.

- For master fund conversion subscription of feeder fund, no service charge difference for the bond fund conversion to stock fund is further collected.

- Fund company’s internal deduction or additional collection of conversion fee is exempted from collection.

Through periodic and long-term investment, investors can save a great deal of transaction fee!

- Master-feeder fund investment subject matter

- Domestic funds

- JPMorgan securities investment trust series

- Allianz securities investment trust series

- Nomura securities investment trust series

- Offshore funds

- JPMorgan series

- Franklin series

- BlackRock series

- Allianz series

- Fidelity series

- AllianceBernstein series

- NN(L) series

- Investment characteristics

- Stop-gain mechanism cycle investment ~ Prevent paper wealth

- Dollar-cost averaging investment policy ~ Separate fund allocation and diversify market increase/decrease

- Asset allocation with balanced stock price ~ Asset allocation to reduce investment portfolio risk

- Reduced fee with conversion fee exemption ~ Save customer’s trading cost and expense

Master-Feeder Fund Investment

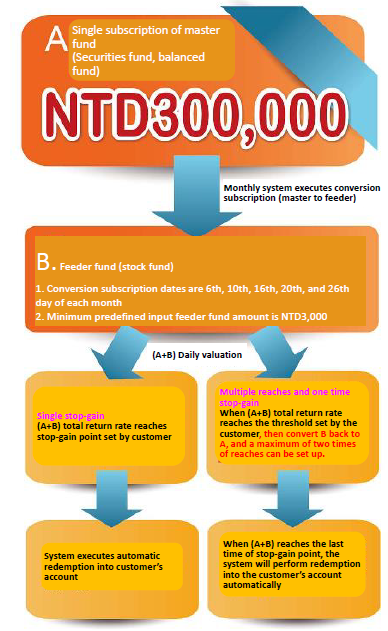

- Investor parks fund of a larger amount at a stable fund (master fund), and agrees to use the dollar-cross averaging method to automatically convert and subscript some certain amount units into active fund (feeder fund) through the system on a monthly basis. If:

- The total return rate of the master fund plus the feeder fund reaches the stop-gain point set by the customer, then the system will perform the stop gain and exit of the master and feeder funds in order to obtain the profit securely.

- The total return rate of the master fund plus the feeder fund has not reached the stop-gain point set by the customer, then the system will continue to execute the investment operation ad valuation of master fund converting into feeder fund, and wait for the great profit timing in order to gain profit and exit!

Attentions for Master-Feeder fund Investment

- Regarding the feeder funds predefined for conversion subscription in this investment, at least one feeder fund is required to be selected for each trust contract, maximum for 5 feeder funds, in order to establish a valid contract.

- During the master fund’s conversion and subscription of feeder funds according to the terms of this investment, the conversion subscription date shall be a dollar-cost averaging payment deduction date of our bank (6th, 10th, 16th, 20th, 26th of each month), and multiple selections of any one day can be made to perform the fixed amount for conversion subscription.

- Master fund and feeder fund shall be funds of one identical series (including different series but belong to one identical offshore fund institution permitting conversion subscription among each other). For the currency of the master fund trust is in foreign currency, the feeder funds for conversion subscription are limited to the ones valued in the same currency.

- For master funds, the minimum investment amount in NTD is NTD 300,000, and for USD, EUR and AUD, the minimum amount is USD, EUR and AUD 10,000 respectively. For feeder funds, the minimum investment amount in NTD is NTD 3,000, and for USD, EUR and AUD, the minimum amount is USD, EUR and AUD 200 respectively.

- The stop-gain point of this investment is calculated based on the sum of the return rates of the master fund and all feeder funds (excluding the feeder funds’ cumulative interest distribution). If there are any undistributed positions therein, then this investment does not calculate the total return rate, the stop-gain will not be executed.

- In case where the master fund or any one of the feeder funds is subject to liquidation, compulsory redemption or being merged, then this investment is terminated automatically.

- The termination of this investment is not equivalent to the application for the redemption of fund, and to redeem the fund, customers are required to apply for contract termination, and to fill the form of “Trust Fund Subscription, Redemption, Conversion, Change Investment Subject Matter Application Form” of our bank in order to proceed with the redemption of fund.

- The net value applicable to the calculation of the stop-gain point is based on the latest net value announcement provided by the fund company and obtained by our bank. If the investment portfolio reaches the last stop-gain point, the system will perform redemption automatically. During the redemption, the redemption amount may be affected by the fund net value and the exchange rate change, such that the total return rate during redemption may not be equivalent to the return rate reaching the stop-gain point.

- For all fees required to be paid for this investment, please contact any one of our business units.

- Any matters not specified herein shall be handled according to the application form and terms described in the agreement of this investment. Our bank also reserves the right to provide the final interpretation for this investment.

Investment Warning

- Trust fund investment is associated with risk, and such risk may cause loss in the investment principle. Investors shall bear the gain or loss of the one’s own investment, and our bank provides no guarantee on the performance for the management or use of trust property, and also provides no guarantee on the principle and interest. Trust property used in subject matter other than deposit is not covered by the protection scope of deposit insurance. As investors enter the trading at different point of time, it will result in different investment performance. The past performance of each fund does not represent the future performance. In addition, the minimum gain of fund is not guaranteed, and investors shall choose subject matter carefully. Each fund is approved or agreed by the Financial Supervisory Commission in order to become effective, following which it can then be raised and sold domestically. However, it does not mean that there are no risks to the fund, and the net value of fund may fluctuation with increase or decrease due to the market factors. If an investment fund selected has interest distribution, then the interest distribution rate of such fund is not equivalent to the fund return rate, and the past interest distribution rate does not represent the future interest distribution rate. Before the interest distribution, relevant fees required may not have been deducted in advance. Furthermore, when a fund permits the use of principle for the payment of interest distribution, the fund interest distribution may be paid from the gain of fund or from the principle. Any parts paid from the principle may cause decrease in the original investment amount. Each fund management company acts a prudent administrator with due care, but is not responsible for the gain or loss of each fund. Investors shall read the fund prospectus carefully before subscription. Relevant feeds required for funds have been disclosed in the fund prospectus and the investor instruction. For domestic funds, please visit Market Observation Post System (MOPS) website (http://mops.twse.com.tw) or website of fund company for inquiry. For overseas funds, please visit offshore fund observation post system website (http://www.fundclear.com.tw) or general agent website for inquiry.

- For further information, please visit any local branch of Chang Hwa Bank or contact customer center direct line:

- For local telephone, please dial 412-2222 (charge in local call rate). For mobile phone, please dial:02-4122222

- Trust Division of Chang Hwa Bank: 02-25362951 Ext. 2214~2219

- Address: 12F, No. 57, Section 2, Zhongshan North Road, Zhongshan District, Taipei City

- Global information website of Chang Hwa Bank: https://www.bankchb.com

.png)