請將裝置改以直向瀏覽,以獲得最佳效果。

:::

Employee Compensation and Benefits

Policy

- The Bank has established the "Work Rules," and all matters including employment, service guidelines, working hours, performance appraisal, reward and punishment, salary and benefits, etc., shall be handled in accordance with such rules.

- The Bank has established the "Employee Retirement Pension and Severance Regulation." Matters regarding employees' retirement pension, compensation payment (including occupational disaster compensation), and severance pay shall be handled in accordance with the regulation; matters not provided therein shall be handled in accordance with the Labor Standards Act and relevant laws and regulations.

Compensation System

Performance Appraisal

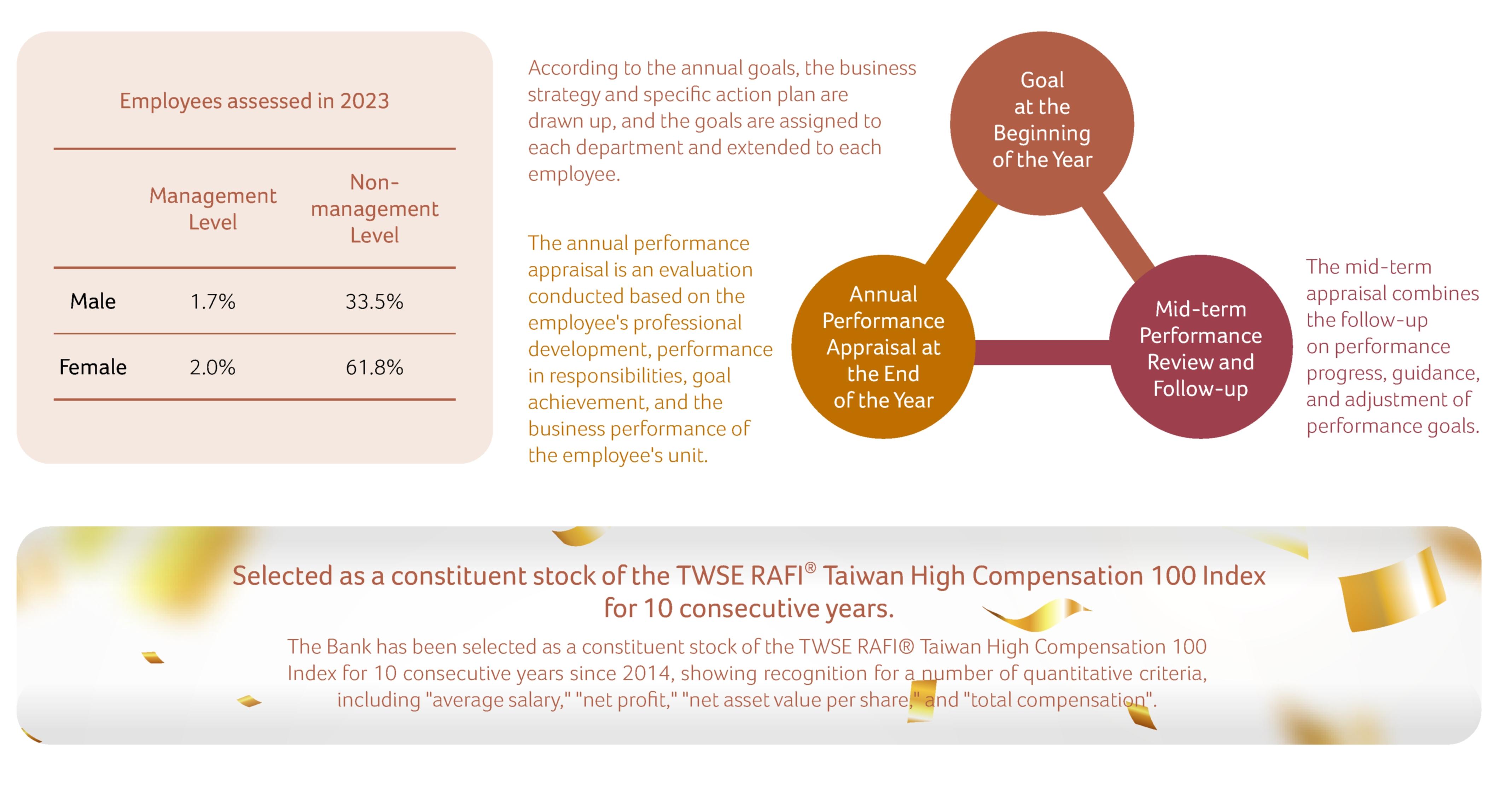

- We have followed the performance appraisal policy, implemented the connection between strategic goals and performance appraisals, and made appraisal results the basis for employee compensation, promotion, training and development, as to create incentives and a win-win situation for the company and employees.

- * The Bank conducts annual performance evaluations in accordance with the "Employee Performance Appraisal Regulations." Employees who have attendance records of more than 180 days in the previous year (including employees who have applied for retirement, preferential retirement, leave of absence, and those who have completed their qualifying period) are subject to performance evaluation, regardless of gender or employee category. In 2023, 99% of the total workforce underwent performance evaluation.

- Performance Evaluation Method

- Goal-Based Management (Twice a year)

At the beginning of each year, the immediate supervisors set individual goals for employees based on unit objectives and job responsibilities. Mid-year performance reviews and tracking are conducted, followed by an annual performance assessment at year-end. Appropriate ratings are given based on the employee's essential skills, key responsibilities, and goal achievement. - Multidimensional Performance Evaluation (Yearly)

An annual manager selection plan is implemented to evaluate whether employees possess the competencies required for managerial positions. This evaluation includes scoring from experienced evaluators based on several major competencies, and interviews with senior executives, to make evaluations from multiple aspects. - Team Performance Evaluation (Ongoing)

Different business units, based on their size, environmental conditions, and business activities, establish various business development objectives from time to time. These performance objectives are assigned to members (staff) within the unit to set individual targets. The progress towards these targets is reviewed periodically according to the established schedule and stages. The unit's final performance serves as the basis for the annual performance assessment. - Agile Communication (Ongoing)

Immediate supervisors regularly observe employees' work, monitor their professional development, performance in responsibilities, and goal achievement. They maintain effective communication and provide necessary assistance or role adjustments as needed. Employees whose job performance falls below expectations will have individual conversations with the responsible and unit supervisors. During these discussions, the reasons for the performance gap will be clearly expressed, appropriate improvement plans or relevant training will be provided, and communication records will be kept to ensure the optimal performance of both the employee and the unit.

Bonuses

- The Bank hands out annual holiday bonuses (including Chinese New Year bonuses and Mid-Autumn Festival bonuses), variable bonuses (performance bonuses, sales bonuses, employee remuneration, etc. issued depending on the nature of a job and employee' s performance)

Annual Salary Adjustment

- Each year, the Bank considers the consumer price index, the salary adjustment standards of the financial industry, and the Bank's annual business performance and profitability, and determines the salary adjustment standards for the current year after comprehensive consideration. At the same time, the Bank takes the concept of "equal pay for equal work" into account and implements reward differentiation, striving for fairness of the salary structure. Salary adjustment are given based on employees' performance appraisal results, with higher performers receiving greater salary increases.

- The average pay increase for employees was 2.18% in 2023

- To courage and show consideration for employees' efforts and implement performance-differentiated raises, the adjustment is conducted with a combination of "performance-based raises" and "fixed raises".

- Performance-Based Raises: Based on employees' individual performance appraisal ratings for 2022, 7 evaluation tiers were established. Corresponding salary adjustments were granted based on the evaluation tier, ranging from 1% to 3.6% of the monthly basic salary.

- Fixed Raises: NT$500 per month for every employee.

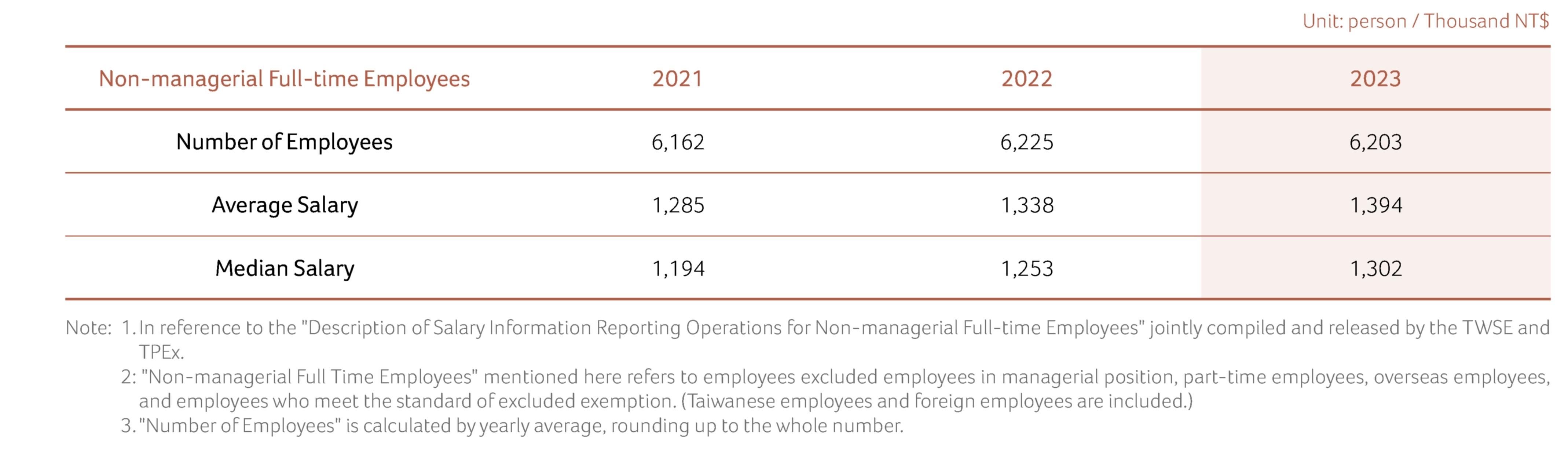

Status of Annual Salary

- Salary Information of Non-managerial Full-time Employees

Notice of Changes in Operations

- In accordance with the provisions of Articles 11 and 16 of the Labor Standards Act, an employer may terminate a labor contract with advance notice under the situation where the employers' businesses are suspended, has been transferred, or suffers an operating losses or business contractions, or where there is a change of the nature of business or a particular worker is clearly not able to perform satisfactorily the duties required of the position held. The minimum period of advance notice is set as below:

- 1. Where a worker has worked continuously for more than three months but less than one year, the notice shall be given ten days in advance.

- 2. Where a worker has worked continuously for more than one year but less than three years, the notice shall be given twenty days in advance.

- 3. Where a worker has worked continuously for more than three years, the notice shall be given thirty days in advance.

Retirement Care

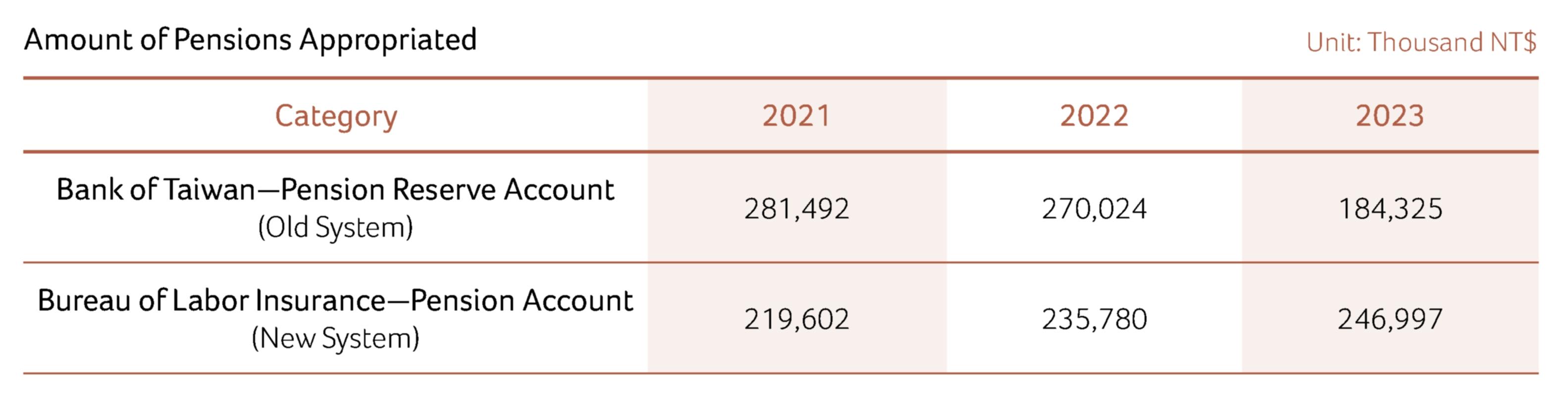

Pension

- The Bank's appropriation of the (old system) pension reserve shall be in accordance with the provisions of the "Labor Standards Act" and the "Regulations for the Allocation and Management of the Workers' Retirement Reserve Funds", and the pension actuarial calculations are made by actuaries commissioned in accordance with the International Accounting Standards No. 19. In addition, according to the new Labor Pension Act, 6% of the employee's salary is allocated to the personal pension account of the Bureau of Labor Insurance each month. Those who voluntarily appropriate a portion of the salary to their own pension accounts, a percentage of the salary decided by themselves will be deducted from the employee's monthly salary to the personal pension account of the Bureau of Labor Insurance.

Retirement Care

- The Bank remains committed to supporting retired employees. In addition to inviting retirees to participate in events held by the Bank (like hiking activities), we offer preferential fees for care trust accounts to assist retirees in planning for a financially secure and comfortable retirement. We also maintain regular contact with retirees through phone calls or in-person visits.

Employee Stock Ownership Trust (ESOT)

- On September 26, 2019, the Bank launched the Chang Hwa Bank Employee Stock Ownership Trust (ESOT). Employees have the option to participate in the ESOT by choosing the minimum self-contribution amount or twice that amount. The Bank will provide an additional contribution of NT$1,000 or NT$1,500 incentive funds to encourage employee participation. The combined self-contribution funds and incentive funds from Chang Hwa Bank is referred to as the trust fund, which is allocated on a monthly basis to the trust account.

- Different self-contribution amount standards are set based on employee ranks and positions, with higher-ranking positions enjoying higher self-contribution amounts. ESOT encourages employees to strive for better performance and provides greater participation opportunities in the ESOT when they are promoted to higher positions. The difference in self-contribution amounts between non-managerial positions and entry-level management positions is approximately 3-4 times higher after about 5-10 years of advancement. This serves as one of the long-term incentives that look after employees and enhance benefits, encouraging them to plan for their retirement by saving for the future. It effectively enhances employee loyalty and morale.

- The performance evaluation criteria for individual employees include the implementation of legal compliance awareness campaigns and self-assessment of legal compliance as the basis of employee performance evaluation on related personnels. The criterion aims to effectively maintain resilient sustainable operations.

Implementation Status

- Member recruitment began in October 2019, and the first payment deduction was made in November 2019. As of the end of 2023, the total number of members was 6,304, (Including 69 people who were on unpaid leave; their membership was retained without payment deducted) with a participation rate of 97.28%; those who chose the minimum self-appropriation amount accounted were 1,892 in the number, accounting for 30.01%; 4,343 employees chose to double the amount, accounting for 68.89%. As of the end of 2023, the shareholding trust ratio among the Bank's workforce below two management level from the CEO is about 97.03%.

.png)

.png)

.png)